ASHE Figures 2020

03/11/2020

If someone had asked me in January what I would be writing about in November when looking at the ASHE figures, I would probably have said Brexit, the US election and increases to the cost of care as usually happens.

I would never have thought that in all my decades of advising clients, a pandemic would help strengthen the argument for a PPO, which can provide the absolute certainty that claimant’s so often need.

This year not gave us only the Covid-19 pandemic, but saw interest rates here in the UK drop to an all- time low. In addition to this we experienced extreme volatility across global investment markets with share values moving suddenly and sharply.

This is a year when clients who had part of their award settled via a suitably indexed Periodical Payment found great security. Not only will the guaranteed element of the payment be of comfort to many, but the certainty it brings means that clients can continue to plan for the year ahead, safe in the knowledge that the payments will continue to be made.

With tax rates likely to increase in the future, the tax free nature of a Periodical Payment is more appealing than ever.

As we enter a second period of lockdown and with the past few months showing that predicting the future is impossible, it is worth remembering that a significant amount of the uncertainty and worry can be removed by having part of the award made via an appropriately indexed Periodical Payment as part of a settlement.

Following the Civil Liability Act 2018, personal injury damages are calculated with reference to the Consumer Price Index (CPI), which is measured using a basket of general household goods and services. However for most claimants personal injury damages are in relation to specialised services such as care and case management.

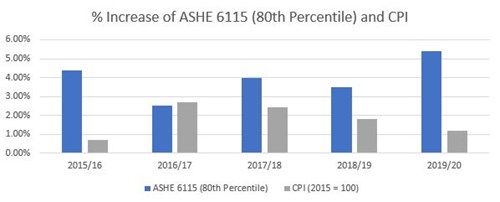

As the graph below shows, prices invariably rise, however it can be seen that the costs of care and case management (measured by the 80th percentile of the ASHE 6115 index) have generally shown a greater rate of increase over the last five years. As such, by having an appropriately indexed Periodical Payment, the possibility of an under provision of funds is mitigated.

Whilst the benefits of receiving a tax free, guaranteed and indexed-linked payment for life sounds perfect, they may not be suitable for all clients. Therefore, it is vitally important to speak with Adroit at the earliest opportunity so that we can assess the suitability of a Periodical Payment for your client. Our team are also experienced at helping clients and Deputies ensure that they receive the correct annual periodical payments, following settlement, by providing periodical payment uplift calculations.

Adroit Financial Planning are experts in the field of catastrophic personal injury and medical negligence and have been for many years. Click here to contact one of our specialists today.

Written by Neil Brownhill, Senior Financial Consultant.