What does the rise in interest rates mean for investors?

17/11/2017

What has happened?

The Bank of England has raised interest rates for the first time since July 2007 by 0.25% meaning that the base rate in the UK now stands at 0.50%.

This hike was very much anticipated and there was an 80-90% chance this would happen. The Bank of England’s Monetary Policy Committee’s vote to raise rates was 7–2, reversing August 2016’s reduction following the Brexit vote to leave the European Union.

Why has this happened?

The Bank of England has been nervous about inflation creeping up; it hit 3% in September, which is 1% above their target. With interest rates as low as they are, people have effectively been discouraged from saving. However, lower borrowing / lending rates can encourage people to take on more debt, without giving much consideration to their liabilities in the future.

What does this mean for Investors?

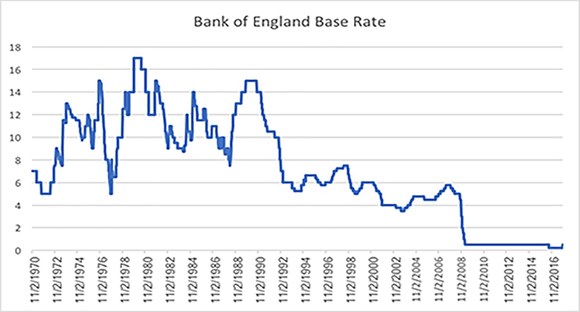

The reality is that rates are still at an incredibly low level and the chart below illustrates just how low interest rates currently are.

(Source:Bloomberg 2nd November 2017)

In terms of future rate rises, the Bank of England will only raise rates when they feel the UK economy is strong enough to withstand it. It is likely that future rate rises will be done in a slow, controlled manner and will be well communicated to the market. The Bank of England is not indicating a further hike over the short term but two more rate rises are anticipated over the next three years.

Interest rates are likely to remain at low levels for some time. For investors, this means that inflation will erode the real value of cash holdings at current levels. When the financial crisis hit back in 2007, Cash ISA’s were paying interest of up to 6.50% p.a. However, earlier this year, Cash ISA rates had fallen to record lows, often paying interest of no more than 1% p.a.

Conclusion

Diversification has always been important and this will remain the case. Over time, the traditional ‘building blocks’ of portfolios (equities, bonds and cash) have become more closely correlated meaning that true diversification can be much harder to achieve. There always has been and always will be uncertainty in markets but diversification can help to reduce risk. It is therefore important to consider the inclusion of new and alternative asset classes as these can help to create a well-diversified investment solution that has the potential to work in all market conditions.

For further investment advice, contact Andrew Taylor