Understanding the New State Pension

14/11/2016

What has happened to the State Pension?

From 6 April this year a new single tier State Pension system was introduced in the UK. The idea was to make it simpler and easier to understand.

The good news is that the full new State Pension is £155.65 per week/ £8,093.80 per annum.

In order to get the full amount, you need to have 35 qualifying years’ contributions (or credits) on your National Insurance record.

If you don’t have the full 35 years, you will receive a pro-rata amount, although you do need to have at least 10 qualifying years on your record in order to get any.

What do you mean by National Insurance Credits?

You can get National Insurance credits if you’re in receipt of certain state benefits. For example anyone claiming Child Benefit, Jobseeker's Allowance, Employment & Support Allowance, or Carer's Allowance may receive credits.

Does the new State Pension increase?

Yes and surprisingly the government has been, on the face of it, very generous with the increases.

Anyone in receipt of the new State Pension will benefit from what is known as the “triple lock” system. This “triple lock” guarantees that the new State Pension will rise each year in line with earnings, inflation or 2.50%, whichever is the highest.

This does seem generous, given that CPI was 1% in September of this year. However, there has been talk of the “triple lock” being scrapped as it’s costing the nation billions of pounds every year.

What about the self-employed?

It’s also good news for the self-employed.

The Class 2 National Insurance (NI) contributions made by self-employed people are now being treated in the same way as employee contributions. So the self-employed will also have access to the same £155.65 per week/ £8,093.80 per annum.

Will everyone get the full amount of the new Single Tier State Pension?

No, unfortunately, there will be lots of people who won’t get the full amount. Anyone who has previously “contracted out” of the second state pension and paid National Insurance Contributions at a reduced rate may be affected.

The amount you receive will depend on the length of time you contracted out for. It’s estimated that thousands of people could miss out on the full amount of new State Pension because of this.

How can I ensure I receive the full level of single tier State Pension?

If you’re likely to fall short of the 35 qualifying years needed to receive the full amount of new State Pension, you may be able to make voluntary contributions.

If you have been employed with low earnings, or unemployed and not claiming benefits, you can pay Class 3. The self-employed or anyone living and working abroad can pay Class 2.

The rates for the current tax year are:

- £14.10 a week for Class 3 voluntary NIC’s

- £2.80 a week for Class 2 voluntary NIC’s

What if I retired before 6 April 2016?

If you reached your State Pension age before the new scheme was introduced then nothing changes and you continue to receive your State Pension in line with the old rules.

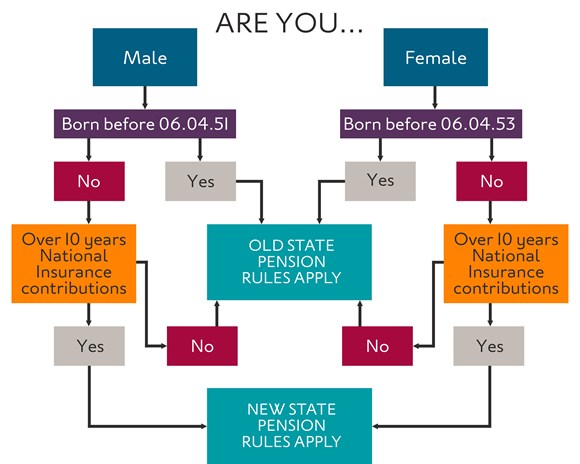

How do I work out whether I qualify for the old State Pension or the new State Pension?

When will I reach my State Pension Age?

It depends on your gender and date of birth. You can calculate your State Pension age here - www.gov.uk/state-pension-age

Even though I am still someway off retirement, how can I find out how much I will receive?

You can request a State Pension statement online at - www.gov.uk/state-pension-statement or by calling 0345 3000 168.

Or you can download, complete and post a BR19 form, which can be found here - www.gov.uk/government/publications/application-for-a-state-pension-statement

The statement lets you know how many qualifying years you have on your record and also how much State Pension you can expect to get.

How does this affect our clients?

It’s important to consider the potential losses that clients may suffer, especially if they are making a claim for damages. You should always ensure that your clients are receiving the correct benefits. You can actually check their National Insurance record to see whether they have any gaps.

The introduction of the new State Pension has had implications, particularly in relation to Fatal Accident Claims. There could now be a loss of dependency on pension in lots more cases.

Obviously it’s always important to be aware of your client’s State Retirement Age.

At Adroit we offer fully independent and impartial advice. Our team of specialist advisers have significant experience in this area, and can assist in a number of ways.

If you have any questions, please contact Andrew Taylor at Adroit on 0800 884 0006 or email Andrew@adroitfp.co.uk