The Impact of the Discount Rate Review

18/01/2017

The discount rate is the assumed ‘real’ rate of return that a Claimant would receive on their damages if they were to invest their monies. In accordance with the guidelines established in Wells v Wells, the current discount rate was set back in 2001 at 2.5%, largely based on the simple three year average of the gross redemption yields of Index Linked Gilts (ILG). This was at that time considered to be the most "risk free" investment available to an investor.

In 2012 the MoJ issued their first consultation paper to consider the methodology and in particular, the following two options:

a) To use an ILG-based methodology applied to current data

b) Move from an ILG-based method to a method based on a mixed portfolio of appropriate investments applied to current data.

No further actions have been taken since 2013. However, in the face of legal action by APIL, the Government has finally announced that a review will take place by 31 January 2017. The Association of British Insurers (ABI) have also launched a legal challenge, calling on the Government to complete its consultation and change the methodology, before the discount rate is reviewed.

We can’t predict what may happen and when in fact the review will take place, given the ABI’s recent legal challenge, however, it’s likely that early in 2017 further guidance will be issued which will affect personal injury and clinical negligence claims.

An ILG is a financial instrument which provides an investor with a measure of risk-free returns in excess of Retail Price Index (RPI) inflation. The ILG provides a semi-annual coupon, which is then inflation adjusted for the length of the term they hold the ILG, as well as a final redemption payment at the redemption date. If an ILG is purchased on issue (on the primary market) an investor would receive their initial investment back at the redemption date.

However, for retail investors (such as personal injury Claimants), ILGs are only available on the secondary market, which can often lead to a negative redemption payment, depending on the premium paid. In recent years, given the economic downturn and the impact of quantitative easing, the demand for ILGs soared, leading to negative redemption yields for most investors on the secondary market, making this form of investment unattractive to private investors.

Given the decline in redemption yields, it would be reasonable to assume that if this method continues to be used to set the discount rate, then the rate could be decreased from the current 2.5%.

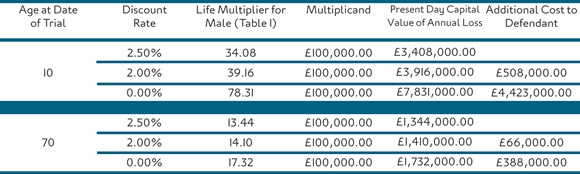

Given the acknowledged decline in redemption yields of ILGs, many professionals in the market believe that by using the same methodology, the discount rate should be reduced to as low as 0%. This would result in an increase to all multipliers used within a Schedule of Loss which would largely increase the overall size of a Claimant’s claim for damages.

However a 0% discount rate would have an adverse effect for a Defendant as they would essentially have to pay out more on day one for on-going/lifetime losses suffered by a Claimant.

For Government bodies such as the NHS or MoD who are often Defendants on the larger value claims, the impact of a reduction to the discount rate could be severely detrimental to their short term budgets.

As shown above, even a modest reduction in the discount rate could increase a claim by almost 15% for a younger Claimant and 5% for an older Claimant (assuming no impairment to life expectancy), whilst any further reduction may see the claim double. Therefore, although the existing methodology based on current data would most likely dictate that the discount rate be reduced from 2.50%, we’re sceptical as to whether the Government would make a decision without substantial consideration as to what their other options may be, due to the huge cost involved.

Despite calls from some parties for the Government to consider the possibility of Claimants making higher risk investments in order to achieve a higher return, by setting the discount rate, the principles established in Wells v Wells would still need to be considered.

A way to reduce risk and optimise returns would be to invest in a well-diversified, multi-asset investment portfolio. This would involve investing in a range of assets such as fixed interest securities, property and equities. A Claimant may benefit from asset classes which are negatively correlated and are achieved by having investments placed in different geographical regions and sectors in order to provide the opportunity for real growth in most market conditions, as the aim would be for each asset class to react differently to political or economic changes as they occur.

However, ascertaining a net rate of return from a multi-asset portfolio for all Claimant circumstances

would be impossible. Although we can’t say for sure what methodology the Government may adopt, the spread of returns from most forms of investments available to retail investors could mean that a change in methodology may result in the Government being able to justify why a 2.5% discount rate could remain appropriate.

Although most Claimant lawyers would be hoping for a reduction, a 2.5% discount rate based on this different methodology could lead to further heads of damage being included in the Schedule of Loss.

In Eagles v Chambers [2003] EWCA Civ 1107 it was thought that the recoverability of investment fees was an attack on the discount rate and was therefore not awarded, but with a change in methodology, the possibility of recovering professional fees for the investment of damages could well become as common as claiming Professional Deputy Fees.

- Ministry of Justice announce that the Discount Rate Review will take place by 31 January 2017.

- Decision could be based on existing methodology, which we believe would provide a strong probability of the discount rate being reduced.

- There could be a new methodology which may still allow Claimants to increase their overall claim, even if the discount rate itself remains the same.

- ABI have launched a legal challenge of the Lord Chancellor’s decision to review the discount rate, calling on the Government to complete its consultation and change the methodology before proceeding.

- In any event, the advantages of periodical payments remain and should not be forgotten.

If you have any queries or need further information regarding the Impact of the Discount Rate, please call us on 0800 884 0006.