How lawyers can safeguard clients' compensation

18/01/2021

Last month, Senior Financial Consultant, Paul Rosson, featured in the APIL PI Focus publication to explain how lawyers can help safeguard clients’ compensation. The article copy is below.

Should you wish to speak to Paul or one of our other financial experts, please contact us online.

Planning for the future

Sadly it’s no longer enough to fight hard to achieve the best possible award for your client. Recent changes in legislation now mean that once settlement is achieved, your client needs to take good quality financial advice and invest their award wisely – or they run the risk of their hard fought compensation running out.

A lump sum damages award is intended to compensate the claimant of a personal injury case for the losses they are expected to suffer as a result of their injury. The aim is to restore the claimant to the position they would have been in but for the injury. This is known as the 100% compensation principle.

The conventional approach is for damages to be awarded by way of a lump sum for all heads of damage. The Personal Injury Discount Rate is applied within the calculation of damages, to adjust the award for the return that is expected to be achieved on the lump sum before it is spent.

When former Lord Chancellor, David Gauke set the current Personal Injury Discount Rate in England and Wales on 5 August 2019 at minus 0.25%, the methodology in arriving at this rate was markedly different from the old Wells v Wells approach. As a result of the Civil Liability Act 2018, the new system for setting the Personal Injury Discount Rate places the onus on the claimant to take risks, and to invest their award properly. The compensation they receive will not be enough to meet their needs if they do not do so!

It’s therefore crucial as lawyers to advise your clients on the need for them to take proper financial advice to ensure their award does indeed last a lifetime.

The Act stated that, unlike in the previous system, clients will now have to take:

- more risk than a very low level of risk, but

- less risk than would ordinarily be accepted by a prudent and properly advised individual investor who has different financial aims.

Essentially, the Discount Rate is ‘net return’ after allowing for tax, inflation and investment charges, and is based on the actual returns achievable by the claimant, rather than the theoretical returns from a single asset class as in Wells v Wells.

The current Discount Rate was arrived at based on the following assumptions:

Clients invest in a portfolio which is split 42.5% in ‘growth assets’ (such as stocks and shares) and 57.5% into ‘matching assets’ (such as government gilts).

- The median return associated with a portfolio of this type would be 2% in excess of Consumer Price Index (CPI) inflation

- A 0.75% drag is to be deducted to account for associated tax and expenses

- Inflation drag for personal injury investors would be 1% in excess of CPI.

In addition to this, the former Lord Chancellor also factored in a margin to reflect the possibility of claimants being undercompensated by virtue of the assumptions made in the setting of the Discount Rate.

It’s therefore reasonable to assume that the Discount Rate in England and Wales is based on CPI inflation (The Bank of England’s ((BOE)) long term target is 2% per annum) plus the anticipated real return on a diversified portfolio of investments, which is deemed to be 2% per annum. So under current legislation, recipients of personal injury awards are required to make an annual return of approximately 4% to meet their long term requirements.

This figure is slightly lower in Scotland due to the lower discount rate (minus 0.75%) and the linkage to Retail Price Index (RPI) inflation, and is higher in Northern Ireland.

However, it’s noteworthy that this calculation is based on the investment of the whole damages award. This is extremely unlikely to happen due to short term capital expenditure needs that are most often required by claimants, and also the need for an emergency cash deposit fund to be held. Not to mention cases where there is a reduction as a result of litigation risk or contributory negligence. All of which means that the claimant may need to achieve a higher return than this.

Low interest rates

On 19 March 2020, the BOE reduced the bank base rate to an historic low of just 0.1%. The Bank is also making itself operationally ready for zero or negative rates should the need arise in future. There is little optimism of cash deposits achieving above inflationary returns any time soon, never mind the levels required to make awards last a lifetime.

A good illustration of this is National Savings and Investments (NS&I), which, as part of the HM Treasury, offers the most secure cash deposit accounts in the UK. The interest rate on one of their most popular accounts, the Income Bond, was 1.15% per annum until 24 November 2020, at which point the interest rate fell to just 0.01% per annum. For a client who invests the maximum protected amount of £1,000,000 into an Income Bond, their current annual interest is around £11,500. This will soon reduce to just £100 per annum.

It’s clear that, although bank deposits are safe and provide easy access to short term capital needs, they will not provide the much needed returns that claimants require over the longer term.

To emphasise this point further: the risk profile of an investment portfolio that is designed to achieve the required rate of return to match the discount rate is likely to be categorised as a ‘lowest medium’ risk profile (level 4 out of 10). This works on the assumption that the investor’s willingness and ability to accept investment risk is just below average. A portfolio matching this risk profile is likely to experience both rises and falls in value. So while there is potential for returns from the investment to match or go above the rate of inflation (in other words, the rate at which the prices of goods and services rise), the investor would need to accept that their investment could fall in value, particularly in the short term.

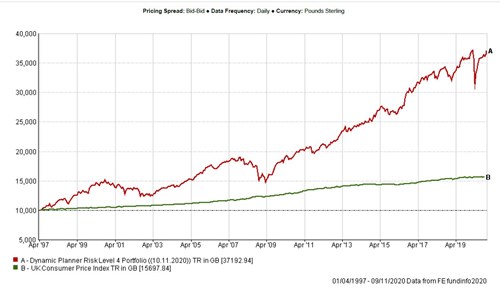

The below chart shows investment returns data illustrating how a ‘lowest medium’ risk portfolio of £10,000 has performed over time compared to CPI inflation.

The chart demonstrates that over time, this type of investment portfolio (shown by the red line) has achieved returns that are significantly above inflation (shown by the green line) even when the investment markets have suffered falls such as during the financial crisis as a result of COVID-19 in 2020.

Given that the Civil Liability Act 2018 stated that ‘the recipient of the relevant damages is properly advised on the investment of the relevant damages’ and ‘invests the relevant damages in a diversified portfolio of investments’, it’s clear that – unless the claimant has a good understanding of investments – proper financial advice will be required.

Specialist help

To ensure that your client is receiving proper financial advice, it would make sense to add into your case management systems, a step that introduces financial advice. This is essential, as in my experience, many clients within the claim process worry about the huge responsibility that will be placed on them to manage their future award when it arrives.

Many solicitors are not experienced in financial matters, as that isn’t their area of expertise. They should therefore direct their client to a suitably qualified and experienced financial adviser, and it’s advisable to keep a record of this recommendation on file; as it’s not unheard of for clients to blame their litigating solicitor for not advocating that they seek proper financial advice when they’ve lost money following settlement without taking any financial advice.

There are many financial advisers out there in the market who are suitably qualified to invest monies on behalf of your clients, but what is needed in a personal injury case is a financial adviser with a good understanding of the client’s ongoing long term needs, and how these can be catered for by exposing the client to as little risk as possible. This is a delicate balancing act that needs continuous monitoring. Many personal injury clients have very complex needs and require regular contact with their adviser, as although in many cases they have large sums of money to manage, the recipients of such awards are rarely financially sophisticated.

It’s therefore best practice to instruct a financial adviser firm that specialises in advising personal injury clients. There are several such firms out there, and their advisers will have a good understanding of what is required for a personal injury client; including the level of risk that should be taken, and also the understanding of how to agree a sustainable long term budget by the use of cash flow analysis and forecasting. One way to find a specialist financial adviser would be to refer to APIL’s Expert Database, or alternatively ask the question on APIL’s Discussion Forum.

This type of adviser generally has a good knowledge of state benefits and the use of personal injury trusts to protect such benefits, and will also have a good working knowledge of advising professional trustees and deputies.

The ideal time to introduce a financial adviser is when the first interim payment is agreed. An adviser can then be asked to provide a free, no obligation meeting, and would be able to explain to the client the financial planning process, and why it’s so important for them to take advice and invest their future award properly. The adviser would also be able to answer any questions the claimant has so that they’re then equipped with a good understanding of what they should do when settlement is reached.

This is also an ideal time for the adviser to assess the need for a Personal Injury Trust (PIT), as the most appropriate time to arrange a PIT is generally at the first interim payment.

By instructing a suitably experienced and authorised financial adviser, you and your clients can rest assured that they will receive appropriate solutions to their long term needs, and can remove a great deal of uncertainty for them in the future.

Contact us

If you have queries or would like advice, please contact us on 0800 884 0006 or contact us online. You can find a list of our finance experts here.