Annual Survey of Hours and Earnings (ASHE) 2016 Figures Released

04/11/2016

Last week, the Office of National Statistics released the data of the Annual Survey of Hours and Earnings (ASHE) and whilst the timing of the early release this year surprised many, we at Adroit believe the key areas to consider are the ASHE 6115 index and RPI as these are the most common indices applied to the indexation of Periodical Payments.

The data refers to ASHE 6115 for continued ease and understanding, although in reality the occupations used in the calculations are ASHE 6145 (Care Workers and Home Carers) and ASHE 6146 (Senior Care Workers)

The data shows increases in care costs across all the percentiles, ranging in increases from 2.78% to an eye watering 8.43%. This higher figure does pose the question “should we be surprised?”

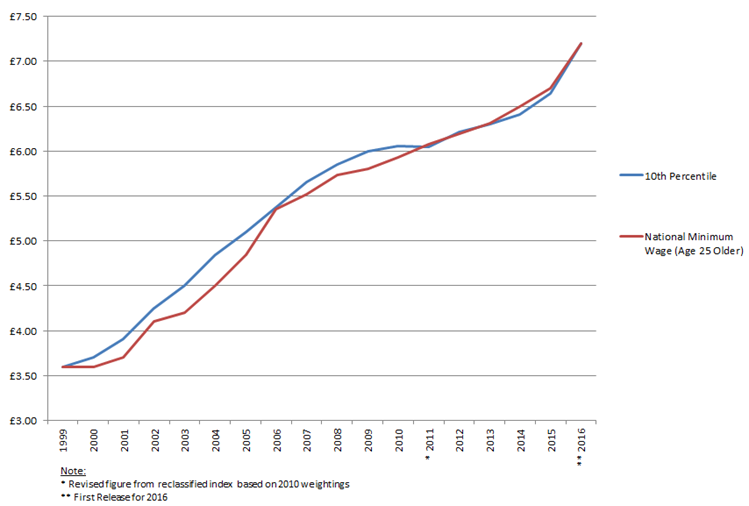

The largest increase we see is in the 10th percentile band of earnings, where the hourly rate is now £7.20. This represents an increase of 8.43% from 2015. It is worth remembering that this figure also reflects the increase in the minimum wage and, as this has risen over the years, there have been similar movements in that percentile as can be seen in the following graph:

The graph essentially shows that the 10th percentile has generally at least matched the National Minimum Wage since 1999, apart from the period between the re-classification in 2011 until now.

At the higher end of the ASHE percentiles, the increases do, in comparison, appear more reasonable. Yet these increases are still significantly higher than the government’s target figure for inflation of 2.5% for RPI. So is this a sign of things to come or an anomaly which can easily be explained away?

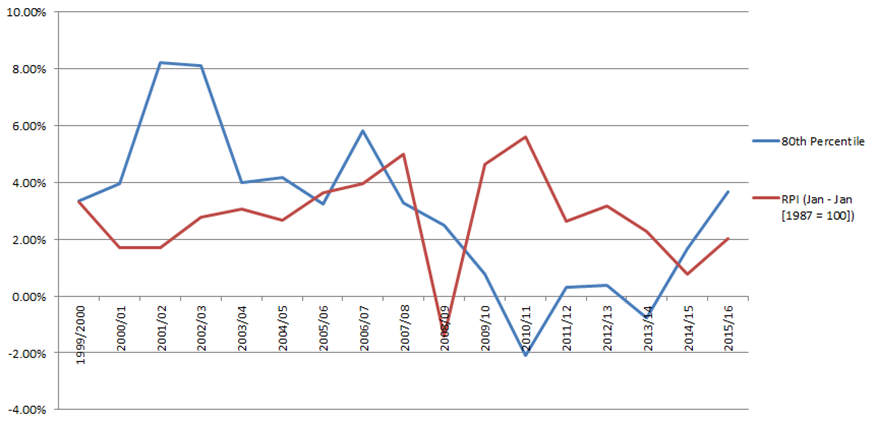

In my experience, a significant number of claims tend to be around the 80th percentile wages figure and over the years this has been towards the lower range of the annual increases. This may be as a result of carers in that earnings bracket tending to be employed by specialist care companies. As such the prevailing market rates could have dictated the pay scales.

We can debate the issues surrounding the increases until the next set of ASHE figures are released. However, the belief of many professional investment advisers is that the threat of inflation has not gone away.

If we consider the historical increases in RPI and the 80th Percentile of the ASHE 6115 index, it can be seen that the increases in each index are negatively correlated i.e. they do not follow the same trend as illustrated in the following graph:

In view of the above, there are some key points that are worth noting.

Firstly, clients in receipt of a Periodical Payment will receive an increase relevant to their agreed percentile, and as such, will not have to be concerned about these increases above inflation.

Secondly, with interest rates at historic lows (and the on-going concerns of some investment professionals about the threat of negative interest rates), then clients holding monies in cash could be at a disadvantage. Therefore inflation risk is a real threat, especially for low risk investors.

Thirdly, economies go in cycles. I have been advising clients for over 25 years and have seen cycles of low inflation followed by cycles of high inflation. Whilst the past decade has had its own unique factors that have influenced inflation, we’ve all heard the expression about history tending to repeat itself.

I don’t foresee a return to double digit interest rates or inflation, but my opinion is that the era of low inflation may be entering its twilight years and higher wage rises may be on the horizon.

These latest figures may raise some eyebrows, especially with the seemingly significant rise in wages across all the percentiles. However, this does illustrate the need for advice, particularly regarding the inclusion of a Periodical Payment for some or all of a client’s future needs.

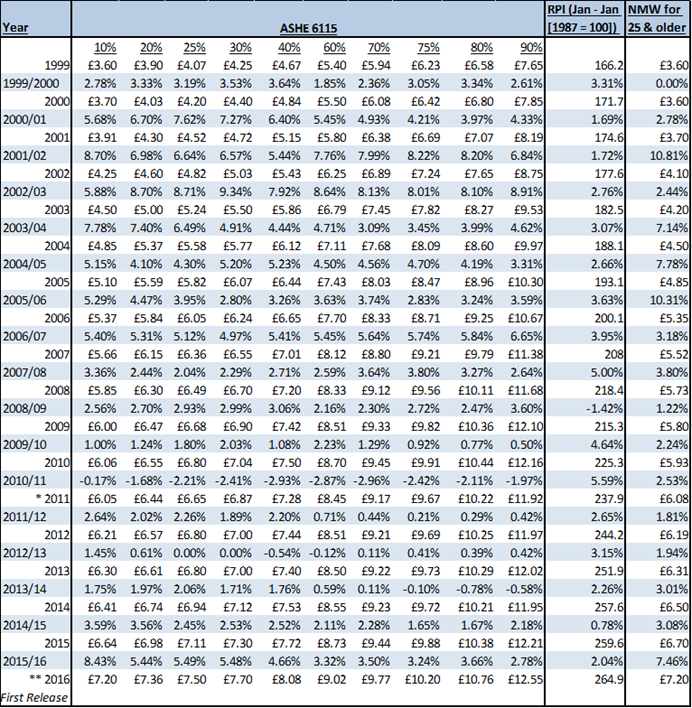

Below are the full hourly (revised) rates of pay for the various indices since 1999 along with the year on year percentage increase .

If you have any questions regarding the suitability of a Periodical Payment for your client, please contact Adroit on 0161 871 8720 or email neil.brownhill@adroitfp.co.uk

The team in Adroit have extensive knowledge and expertise in this field in regard to both advising on the suitability for the inclusion of a Periodical Payment as well as checking the annual uplift for orders already in place.