Understanding Fees and Charges Before Investments Are Made

19/05/2017

Historically, the Financial Services industry as a whole has not been without criticism in relation to the way it operates and in particular, the charges it levies. The FSA’s Retail Distribution Review (RDR) came into force in 2013 and attempted to address these concerns and improve consumer confidence.

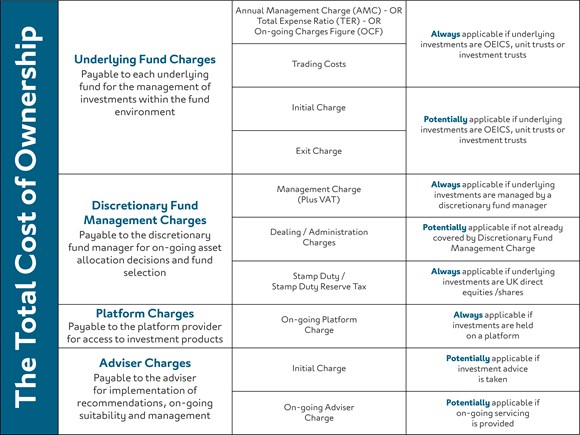

Whilst massive strides have been made in improving professional standards, advice and cost transparency, it can still be a tricky area to fully decipher. Fees and charges eat into investment growth so it’s crucial that these are fully understood before any investment is made. It’s important to consider these costs in conjunction with the quality of the service provided and the growth potential of the particular product. There are typically four layers of charges; these are detailed in the table below.

Underlying Fund Charges

Underlying fund charges encompass the management and trading of each underling OEIC, unit trust or investment trust. Unlike other charges, they are taken from any income generated by the fund or from the fund’s capital and reflected within the unit price; because they are not physically withdrawn from a client’s portfolio they are inherently less transparent and can be overshadowed by good investment performance. Charges will be found on each individual fund’s “Key Investor Information Document”.

The On-going Underlying Fund Charges can be quoted using three different terminologies - Annual Management Charge (AMC), Total Expense Ratio (TER) or On-going Charges Figure (OCF). Whilst the common perception is that these terms are interchangeable there are some subtle differences to be aware of. The AMC covers the standard, annual, static cost to running the fund ONLY. Be wary when this figure is quoted on a fund’s marketing material as it does not cover any additional costs associated with managing the fund which can often be substantial. The TER and OCF are very similar in that they both include the AMC plus any additional, on-going, variable costs. The only difference being that the TER does not cover any performance fees or one-off charges. For this reason, the OCF gives the most accurate measure of what it actually costs to invest in a fund.

Trading Costs are not included in any of the On-going Underlying Fund Charges figures, these are the additional, variable charges related to the buying and selling of assets within the fund. Trading Costs will include any stockbroker commission and stamp duty.

On-going Underlying Fund Charges and Trading Costs will depend heavily on the fund’s strategy; funds that trade regularly will have higher costs and funds adopting a longer-term, buy and hold approach will tend to be lower. The hope of the more active funds is that the extra returns made from making successful trades will outweigh the additional trading costs involved. An adviser or discretionary fund manager should endeavour to select funds that have found the right balance of cost and return, and that also fit best with each client’s needs.

Some funds will charge an Initial Charge and/or Exit Charge; these are fairly self-explanatory, one-off charges that apply to any purchase or disposal of the fund. Imposing an initial or exit charge is no longer the norm however it is still something to be aware of and look out for on the “Key Investor Information Document”. If an adviser or discretionary fund manager selects a fund where one, or both, of these charges are applicable there should be justification behind this.

The overall Underlying Fund Charge will vary over the course of the investment, especially where a portfolio is managed by a discretionary fund manager, however, it is reasonable to expect an annual approximation to be provided based on the current proposed asset allocation.

Discretionary Fund Management Charges

An adviser will sometimes use a discretionary fund manager to manage the day to day running of an investment portfolio. Whilst this adds an extra layer of charges the client benefits from their portfolio being actively ran by highly experienced investment managers. However, it is important to be aware that they are typically unable to ascertain the suitability of a particular investment meaning it is often still necessary to consult an adviser in the first instance. There are a vast number of discretionary fund manager offerings on the market utilising different investment styles and instruments. An adviser will undertake comprehensive due diligence to ensure the provider selected is the best fit for the client and suits their objectives. Specific charges will be found on the investment proposal put together by the discretionary fund manager.

Most discretionary fund managers do not charge any initial fee, typically operating on an on-going Management Charge basis to monitor the underlying investment allocation and react, at their discretion, to any market and wider economic changes. This charge is typically subject to VAT at 20% which may or may not be included in the quoted fee. Some discretionary fund managers may also charge an exit charge should a client wish to terminate their services; again this is uncommon but something to take into consideration at the outset of any agreement.

Dealing/Administration Charges are often included within the Management Charge to give one straightforward figure however sometimes they will be quoted separately as either a percentage or fixed fee per transaction. These charges can apply to a range of admistration tasks such as trading, ISA subscriptions, ad-hoc valuations, tax information, dividend collection and cash transfers. If a single Management Charge is quoted only it is worth confirming whether there are further charges payable for any other specific tasks.

Stamp Duty/Stamp Duty Reserve Tax (SDRT) is payable on the purchase of UK direct equities/shares only at a rate of 0.5%. In real terms, this means if a portfolio has £1million worth of direct equities there is a charge of £5,000 on the initial purchase. However, it is important to not just consider this charge at the outset as it will be applicable whenever equities are purchased. A discretionary fund manager will make numerous changes to the underlying holdings throughout the lifetime of an investment and each purchase may be qualifying for Stamp Duty/Stamp Duty Reserve Tax (SDRT). If shares are purchased electronically, Stamp Duty Reserve Tax (SDRT) is payable and if shares are purchased using a stock transfer form it is Stamp Duty (if the transaction is over £1,000). NB: Stamp Duty/Stamp Duty Reserve Tax (SDRT) is NOT charged on the purchase of gilts, unit trusts or OEICS. It is not usually charged on the purchase of foreign shares however other charges may be applicable.

Platform Charges

A platform is a secure, online solution for managing investments, used by individual investors and advisers alike. It gives easy access to a variety of fund management options and investments made via a platform often benefit from reduced underlying fund charges.

An On-going Platform Charge is only applicable if the investment is made via a platform, sometimes a client is more suited to direct investment and therefore there will be no On-going Platform Charge payable. Platform charges can be a fixed fee or percentage based, typically reducing dependent on the value of a client’s investment.

Adviser Charges

An adviser is the first step in the investment process; they are responsible for creating a holistic financial plan, setting achievable objectives and ascertaining the suitability of any recommendations made. As part of the FSA’s Retail Distribution Review (RDR), rules were introduced in January 2013 meaning advisers can no longer take commission from investment, pension or retirement income products. Instead, advisers must take a transparent fee for the initial advice and/or on-going servicing of a product. This is generally a percentage of the proposed investment, however, may also be based on an hourly or fixed fee basis .The previous commission based system was unclear and led many to believe advice was being given for free, it also raised the suspicions of bias as the adviser was being paid, in effect, by the provider and not the client NB: Advisers are still permitted to take commission from protection products however, more commonly, will chose to waive this and apply a clearer, percentage charge instead. The adviser must provide the charging structure upfront and in writing, it should then be agreed with the client as soon as reasonably possible.

An adviser will sometimes require the payment of an Initial Charge. If applicable, this is to cover the initial risk and suitability assessment along with the administration involved in setting up a new investment. It will also typically cover the cost of all face to face meetings.

An On-going Adviser Charge can only be taken if the adviser is providing a genuine, on-going service. On-going servicing can vary but typically covers regular review meetings, valuations and amendments to investments based on changes in a client’s circumstances including any withdrawals required. In addition, an adviser may continue to advise on maximising tax efficiency and provide the client with any information required to submit necessary tax returns including capital gains tax reporting.

For more information about investments, please contact us at enquiries@adroitfp.co.uk